What’s happening in the occupational market?

Fundamentals are robust by and large, with performance primarily driven by the lack of supply across key centres and supporting rental growth, especially at the quality end of the market. Development activity is increasingly constrained, with pipelines limited in a number of key locations. This does, however, present opportunities for the redevelopment and repositioning of secondary stock as companies continue their ‘flight-to-quality’ strategies.

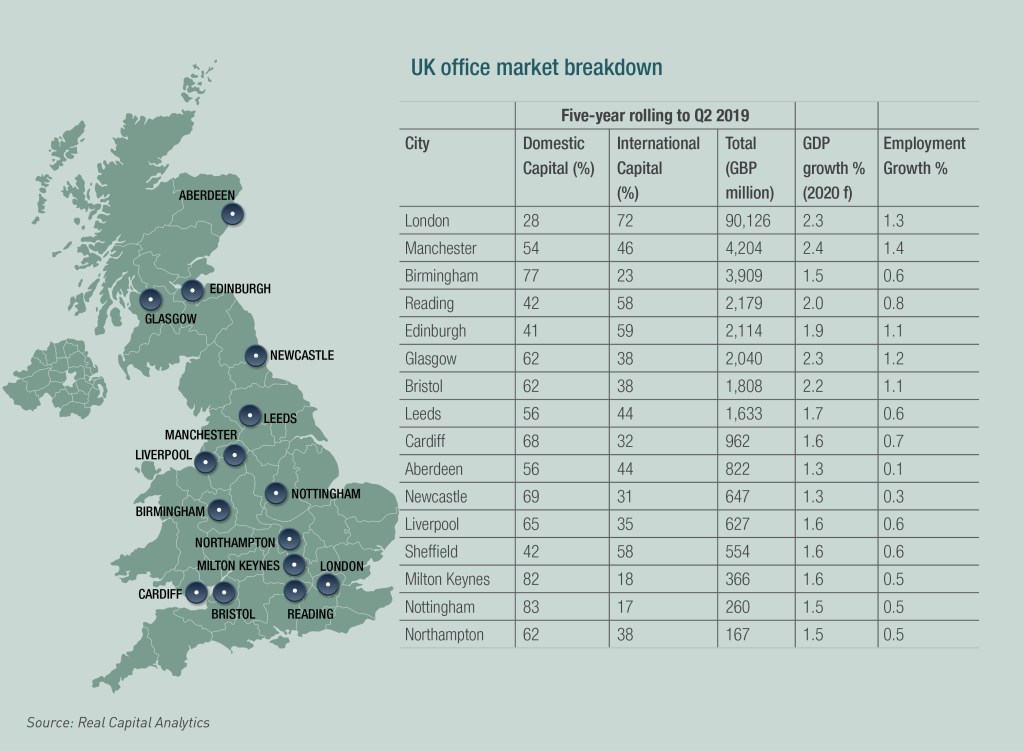

Vacancy in London is 4.25%, having declined since the beginning of the year despite a slower Q1 2019 in terms of take-up, with Q2 seeing a more robust performance. More stock is coming through, with an estimated 13.2 million square feet (1.2 million sqm) under construction, but this is unlikely to dramatically impact the level of availability as around 55% has already been let or is under offer.

Active demand is also holding up well against the political headwinds, and at approximately 3.7 million square feet (344,000 sqm) is above the ten-year average of around 3.0 million square feet (279,000 sqm), suggesting the slower start to the market is not here to stay and a pick-up in activity will follow in the coming months.

With that said, there are further reasons for optimism. Both the professional services and technology sectors are forecast to account for the majority of London’s GDP growth in the next five years, which should translate to a need to increase headcount. Oxford Economics highlights other positives for London, including the continued high performance of London’s universities and colleges, an unusually young population, flexible labour market, and relatively easy access to finance. These strengths should help counteract the negative impact from Brexit as well as the threats to the global economy.

Regionally, 2.34 million square feet (217,000 sqm) of space was let in Q2 across the ‘Big Nine’*, bringing the half-year total to 4.3 million square feet (399,000 sqm), 10% above the long-term average. Activity was heavily focused on larger deals, quality space in city centres and flexible space. The technology sector was very active while there was a retraction from traditional sectors such as financial, professional and business services.

What are landlords doing? Flexible working

Landlords need to be creative and flexible. The way that office space is being used is changing, and owners and investors need to be open and responsive to these changes while looking to preserve income streams. The war on talent continues and the need for companies to tap into talent pools and having them accessible to transport infrastructure is increasingly important, as is the need to provide services and amenities in the office that were unheard of ten years ago.

Technological advancements, supporting the changing needs and lifestyles of employees and facilitating the rise of small businesses, as corporates strive to facilitate a productive workforce, are boosting the need for flexible space. In addition, the desire from larger corporates to have space they can expand into and divest from at short notice is more prevalent in today’s world than ever before.

Co-working space is gaining prominence amongst flexible operators. Conventional landlords are making a move to enter the market as well, rather than simply rent their buildings to flexible operators, they are looking to take a share of the profits.

Flexible workspace providers remain an important driver of leasing activity, accounting for 15% – 20% of office take-up in the UK capital over the past three years. The UK is also an important and growing market for flexible workspace solutions, with the concept being increasingly adopted with new entrants to the market alongside the established providers. Currently an estimated 5.1% of Central London’s office stock is occupied by flexible workspace operators, up from just 0.8% in 2008.

Given their success in meeting the needs of their customers, this trend is here to stay.