The Spread: What other factors impact capital values?

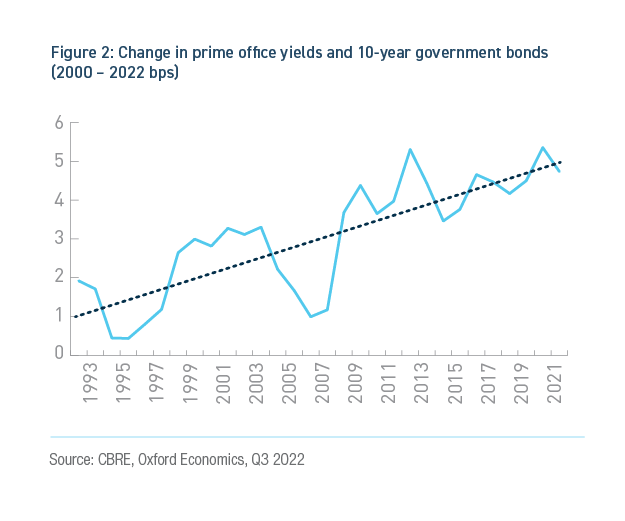

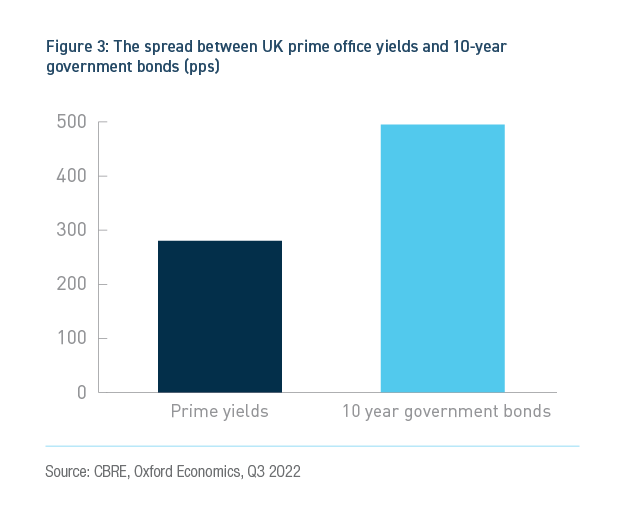

The volatility in the real estate-bond yield spread suggests the complex influence of several factors playing a role in affecting real estate yields. These include capital markets, macroeconomic variables, and real estate fundamentals.

The spread is related to the expectations around rental and capital value growth, which in turn are related to the supply/demand dynamics of a particular market. If demand for real estate from investors and/or occupiers is high relative to supply, then there will be a downward yield pressure. Where supply is high, for example due to a wave of development completions or occupier bankruptcies, this would exert upward yield pressure.

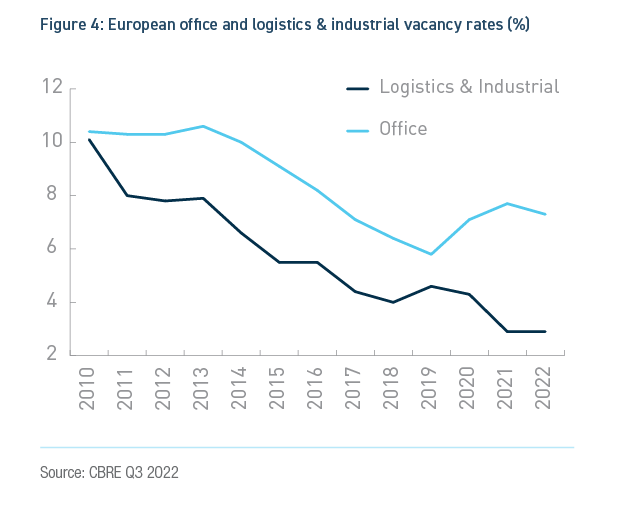

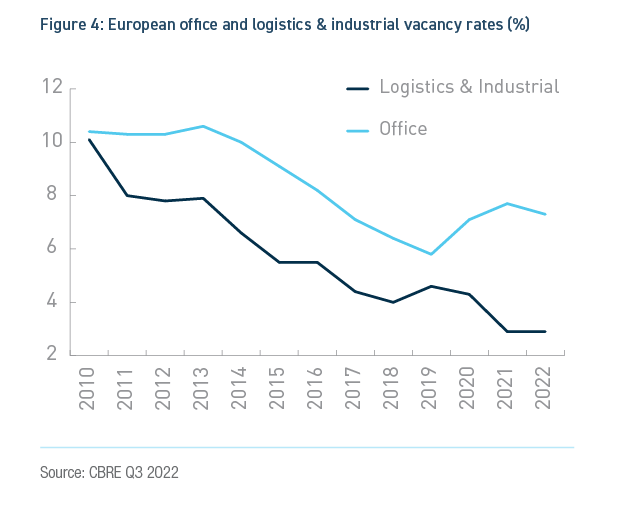

Despite the disruption brought on by the pandemic, many markets in both the office and logistics sector are undersupplied with available space. Figure 4 shows how the vacancy rates across European office and logistics and industrial properties are significantly below the levels witnessed in the aftermath of the GFC.

A combination of rising construction costs and economic uncertainty has also impacted the development pipeline for both the office and logistics sector. The lack of new stock being brought to the market will exacerbate the current supply/demand dynamics and cause faster prime rental growth.

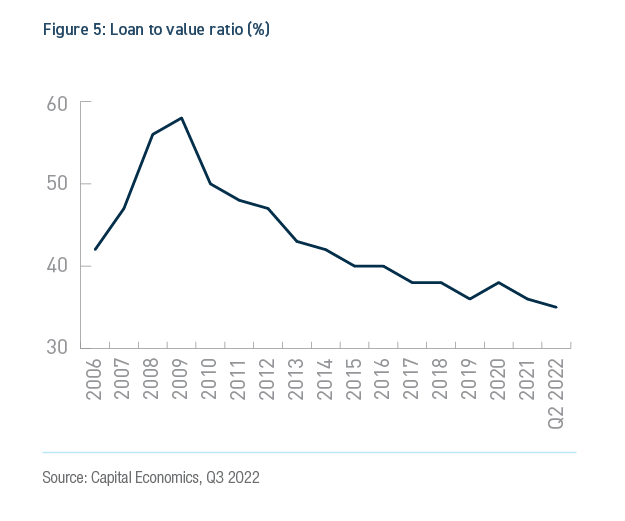

Debt financing availability has also risen over the last decade due to greater availability of non-bank lenders. This will help maintain yields more than has been done in the past when interest rates rise.

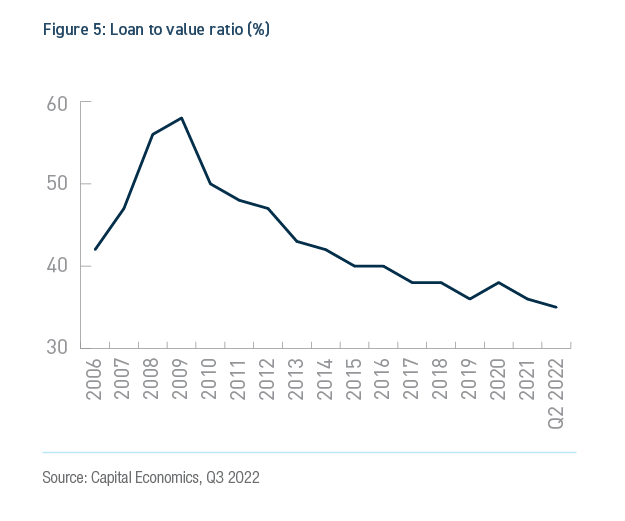

Companies are also in a much healthier position today than they were during the GFC. Figure 5 shows the average loan to value ratio across Europe which has declined from a high of 58% in 2009 to 35% at the end of Q2 2022. As such companies should be better able to protect the downside during a weaker economic environment and, crucially for real estate investors, continue to pay their rent.

The weight of capital targeting real estate across Europe has doubled over the last ten years due to both greater desire for real estate exposure amongst historic investors and new entrants to the market such as sovereign wealth funds.

The significant weight of capital was reflected in the investment volume during the first half of 2022 which totalled €143bn according to RCA. This was the largest transaction volume recorded in H1, and also makes Q2 2022 the second highest rolling 12-month period on record, reflecting investors strong desire to put their money into real estate.