Supply chain adaptation will boost European occupier demand

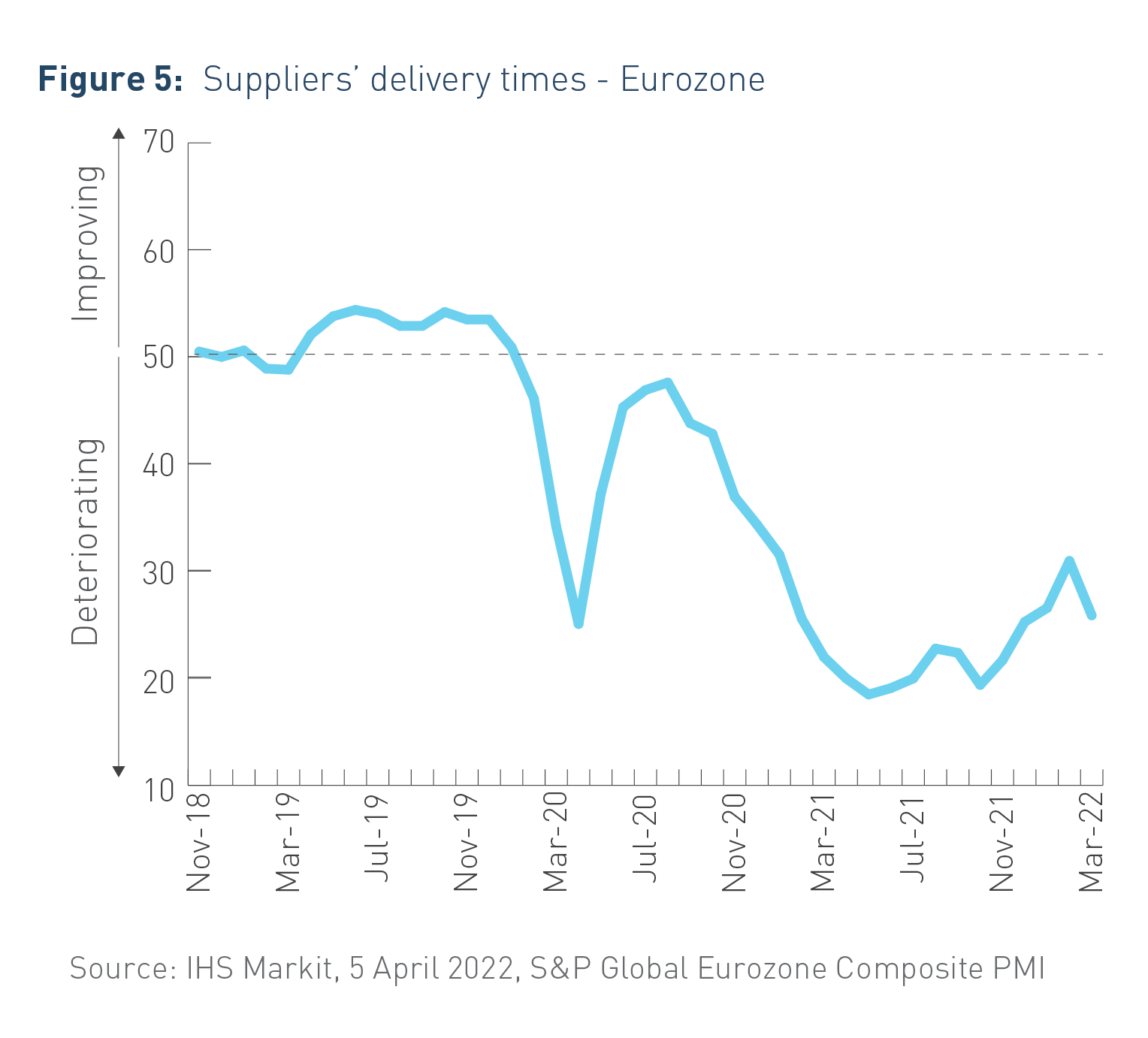

A retreat from global supply chains is underway as businesses seek to maintain greater local inventories and production capacity. As global logistics networks are strained, businesses cannot yet fully enact their re-organisational plans despite a strong desire to do so. This implies momentum has yet to build and will only accelerate. More local inventory and production means more physical space required. With logistics and industrial/light industrial floorspace supply already at record lows across Europe, intensifying occupier demand will create even stronger rental impetus.

A retreat from global supply chains is underway as businesses seek to maintain greater local inventories and production capacity. As global logistics networks are strained, businesses cannot yet fully enact their re-organisational plans despite a strong desire to do so. This implies momentum has yet to build and will only accelerate. More local inventory and production means more physical space required. With logistics and industrial/light industrial floorspace supply already at record lows across Europe, intensifying occupier demand will create even stronger rental impetus.

From global to local: how supply chains are changing

One of the most immediate and lasting impacts of the COVID-19 pandemic has been supply chain disruption. Erratic swings in demand – toilet rolls and computer monitors one minute, bicycles the next – were exacerbated by logistics interruptions ranging from congested ports and the Suez Canal blockage, labour shortages across the transportation industry and bans on certain exports deemed to be of national importance.

The extent of the disruption reflects the international nature of supply chains which first emerged in the 1980s enabled by new technology and globalisation.

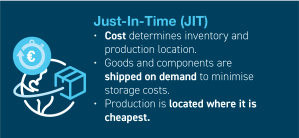

A ‘Just-In-Time’ (JIT) supply chain philosophy in which decisions on where to source, manufacture and store stock are made purely on a financial basis has become standard practice. Goods and components are shipped on demand just before they are needed to minimise storage costs and optimise working capital. Production facilities are located in emerging economies with lower labour and operational costs.

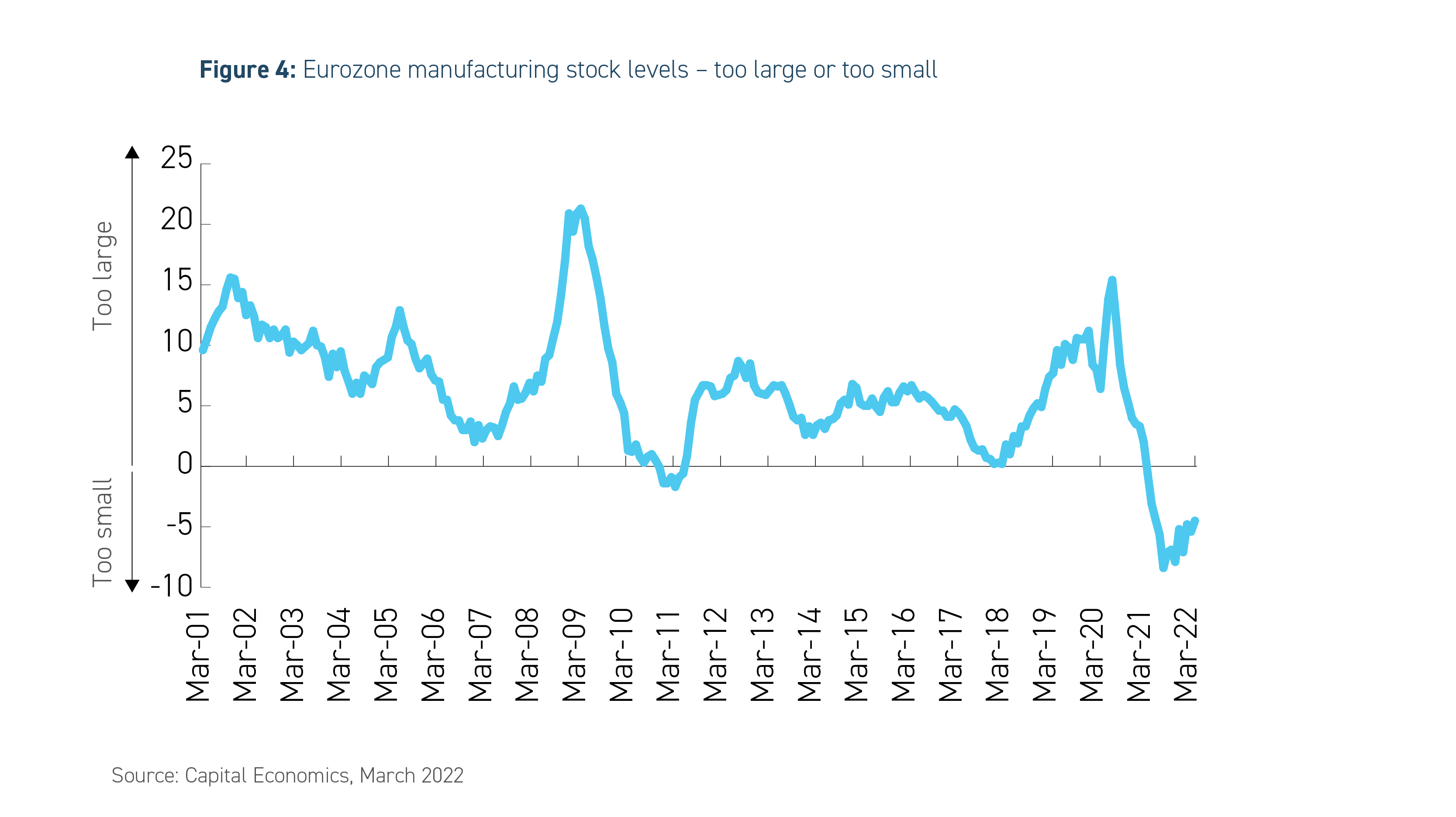

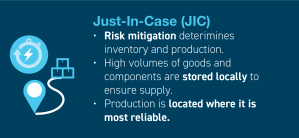

The downside of JIT networks is that they rely on stability and do not cope well with sudden, unexpected change. Rapid demand fluctuations, shipping backlogs or border issues erode their functionality and undermine the ability of businesses to fulfil orders. Reliably mitigating disruption means prioritising resilience over cost, with higher volumes of inventory being stored and production being undertaken locally where it can be better guaranteed. This is the ‘Just-In-Case’ (JIC) approach, the benefits of which have been viscerally demonstrated by the pandemic and, as a result, a mass pivot towards it is underway.

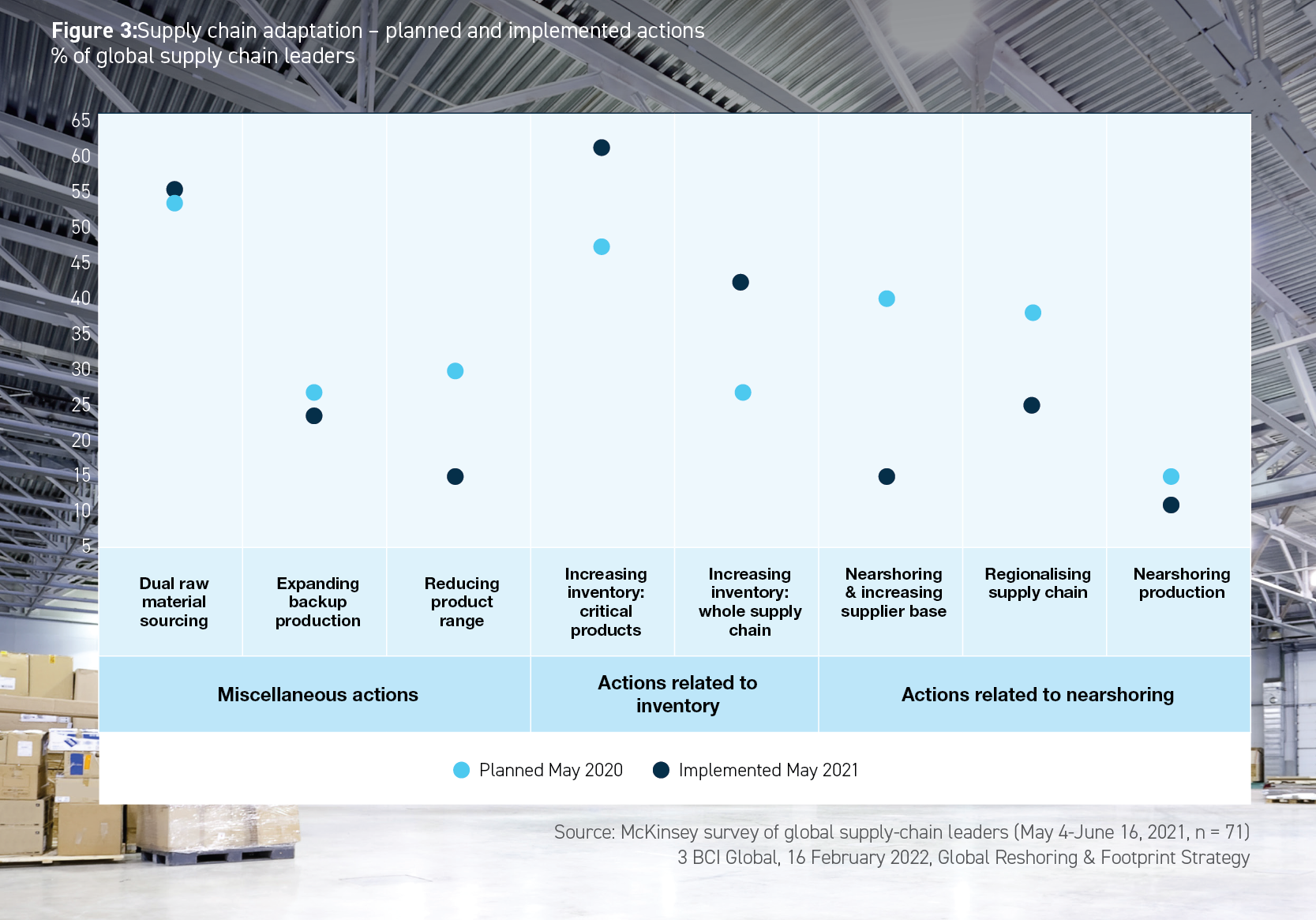

A global survey of senior supply-chain executives by McKinsey, a management consultancy, in Q2 2020 found that 93% planned to make physical changes to their supply chains to ingrain flexibility, agility and resilience in response to the pandemic1. Multiple initiatives were planned including diversification of raw material sourcing, increasing critical inventory and nearshoring production and suppliers.

A survey of global CEOs by KPMG, a professional services firm, in Q3 2021 established that ‘supply chain risk’ was jointly ranked as the top threat to business growth alongside cyber security and climate change risk2. It was ranked second in 2020 reflecting the growing awareness of, and concern with, supply chain risk. There was a marked 10 percentage point increase in CEOs rating this as the biggest threat. Supply chain adaptation is clearly at the forefront of corporate agendas.