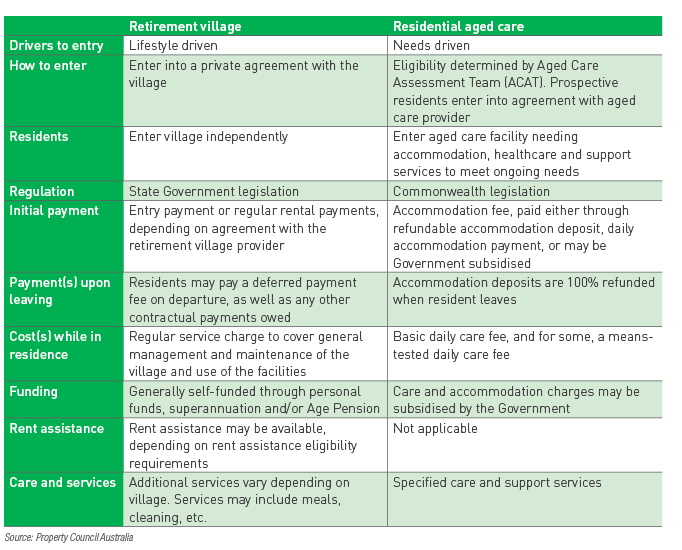

Retirement living and aged care: What’s the difference?

Retirement living

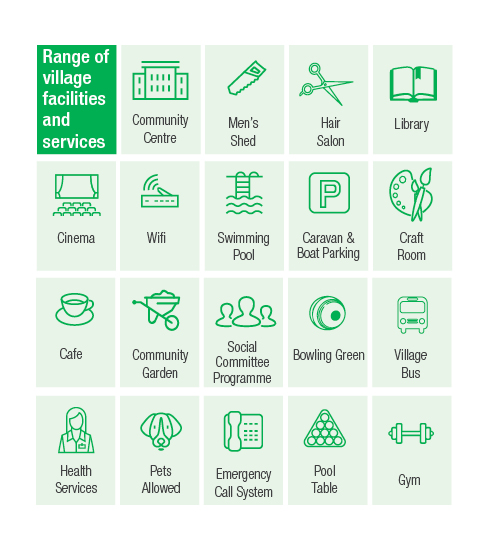

Defined as a residential dwelling and lifestyle complex, generally for independent and self-funded retirees over the age of 55, retirement living villages are made up of private homes, called Independent Living Units or ILU’s, and usually offer a range of shared facilities, such as community centres, pools, gyms and sports facilities.

According to the most recently available data, there were just over 170,000 ILUs in 2016, housing over 220,000 people. As baby boomers start to retire, it is anticipated that by 2036, the market will have approximately doubled in size1.

However, there is an increasing disparity between actual supply and this demand. The November 2018 PwC/Property Council Retirement Census, which saw contributions from 52 retirement living operators representing over 610 villages showed only 2,000 new ILUs are set to hit the market each year across the next four years. This current rate of supply is, on average, less than one quarter of what is required.