Economics and demographics: Dynamism in leading occupier demand indicators

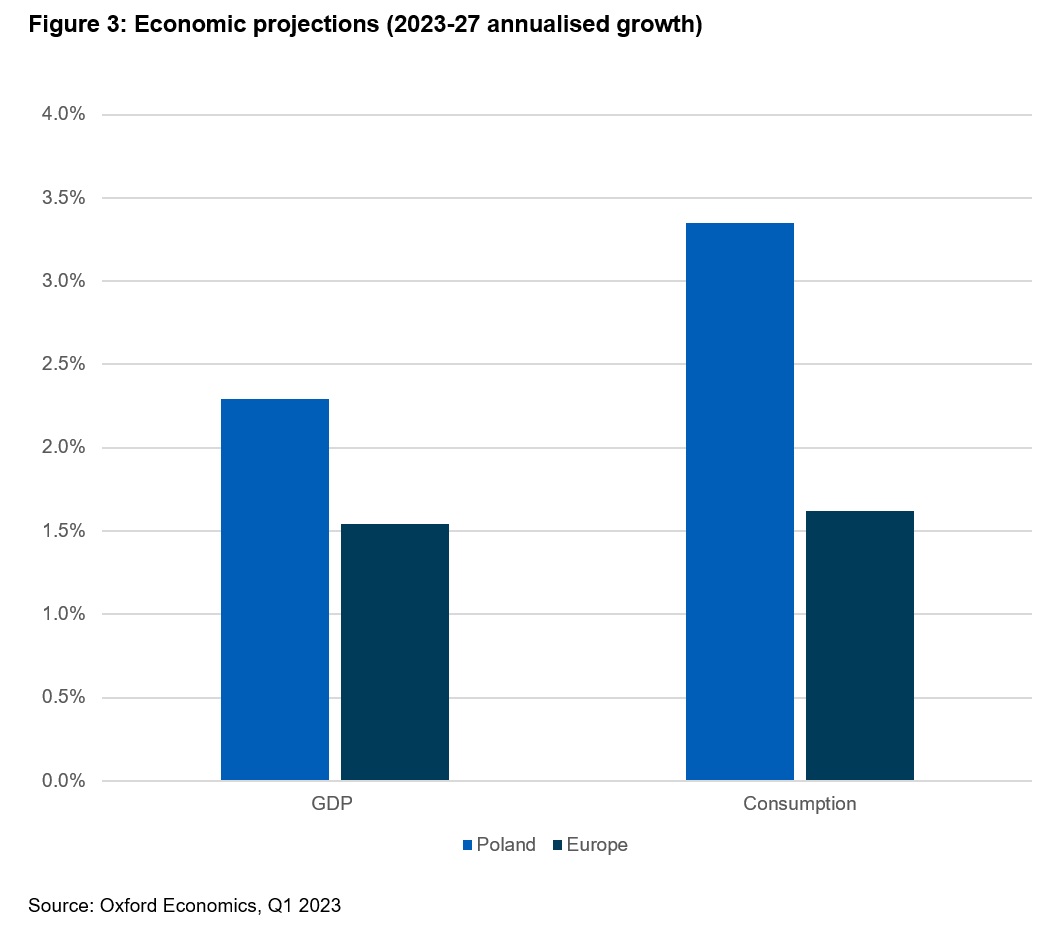

According to Oxford Economics, Poland will benefit from some of the strongest economic growth in Europe over the next five years (figure 3). Because such growth is a leading indicator of occupier demand, this bodes well for real estate performance. However, we believe that even these bullish growth assumptions may be too pessimistic as they fail to account for the full impact of Poland’s post-war relationship with Ukraine.

Poland has been a hub for shipping arms and aid to Ukraine over the last year. Post-war, it will be the conduit through which the reconstruction effort is funnelled. Given the damage Russia has inflicted – the reconstruction costs are estimated by the World Bank amount to €322 billion so far – that effort will be significant. There is talk of a new Marshall Plan, the American programme that turbo-charged Europe’s economic recovery after the second world war. Poland’s leading role in the reconstruction effort will be solidified by the international creditability it has gained by virtue of its resolute response to the invasion. This will translate into far greater foreign direct investment (FDI) from international capital once the risk perception declines.

Poland has been a haven for Ukrainian refugees, with 7.5 million fleeing across the border according to the European Investment Bank. Some 1.5 million are estimated to remain there today, many of whom are likely to settle permanently. The presence of so many additional people has caused some immediate tensions by exacerbating pressure on housing and social infrastructure. Short-term challenges aside, these immigrants will inject dynamism into Poland’s demographic profile by adding labour and population. The new arrivals tend to be younger and better educated than the average Pole. It will be an attractive destination for corporate occupiers seeking to tap that plentiful, affordable supply of skilled labour.

Current forecasts do not, in our view, fully account for the additional economic and demographic growth impetus associated with these factors which will directly translate into stronger real estate demand.

Conclusion: Unwarranted risk and solid fundamentals make Polish real estate an investment gem

In summary, we believe that the Ukraine-related risk of Polish real estate investment is over-estimated. We also consider that economic and demographic growth drivers will stimulate sustained occupier demand in the medium-term and long-term. Investors who access the market now can secure assets and development sites aligned to future demand and associated rental growth at higher yields than will be available once the Russian-Ukraine conflict settles. Exposure to capital and income growth potential will, if executed correctly, deliver out-performance. That is why we are so optimistic on Polish real estate.