Poland to continue to prosper

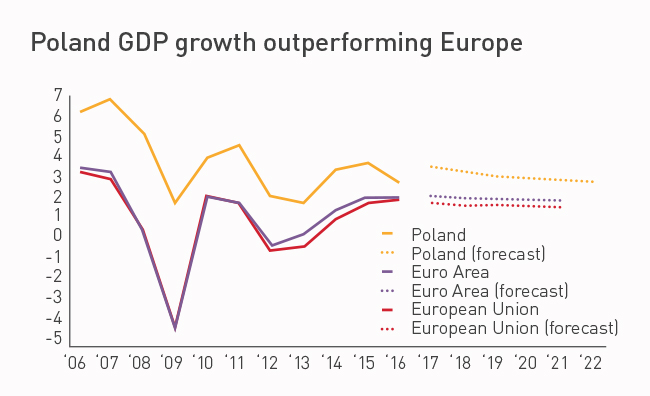

Almost three decades removed from communist rule, Poland has emerged as the growth engine of the Central European economy. From its inclusion in the EU, to its strong future growth forecast, there are numerous reasons that highlight Poland as a potential investment destination.

History

Poland’s long, often dark history has been wrought with hardship. The formal beginning of World War II was marked through the invasion of Poland on 1 September, 1939. By the end of the war, Poland had lost over 6 million people, more than 20% of its prewar population.

44 years of communism followed, prior to its collapse in 1989 after Poland’s first partially free and democratic elections since the end of the war. The early 1990s saw significant reforms that allowed the country to transition from its socialist-style planned economy into a market economy.

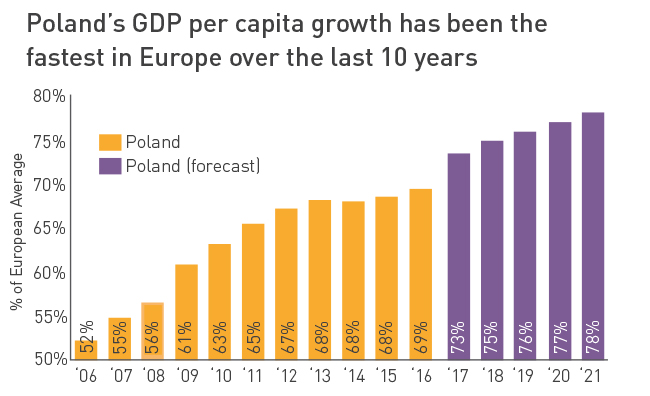

The two-and-a-half decades since has seen Gross Domestic Product (GDP) rise from USD$1,731 per capita in 1990 to USD$12,399 per capita in 2016. This was the fastest growth amongst all OECD nations. GDP per capita is still only just over a third (34.8%) of the European Union (EU) average, leaving strong upside for future growth to occur.