The state of the office market

As businesses countrywide adopt hybrid work models – and employees are encouraged back into the office – the market continues to adapt to the diverse needs of tenants and occupiers. Vacancy rates are shifting slightly across CBDs, Knight Frank predicts that short-term market disruption is more likely to be in the form and function of office space – there is a growing expectation that building owners create office space experiences to entice work-at-home staff back into CBDs.

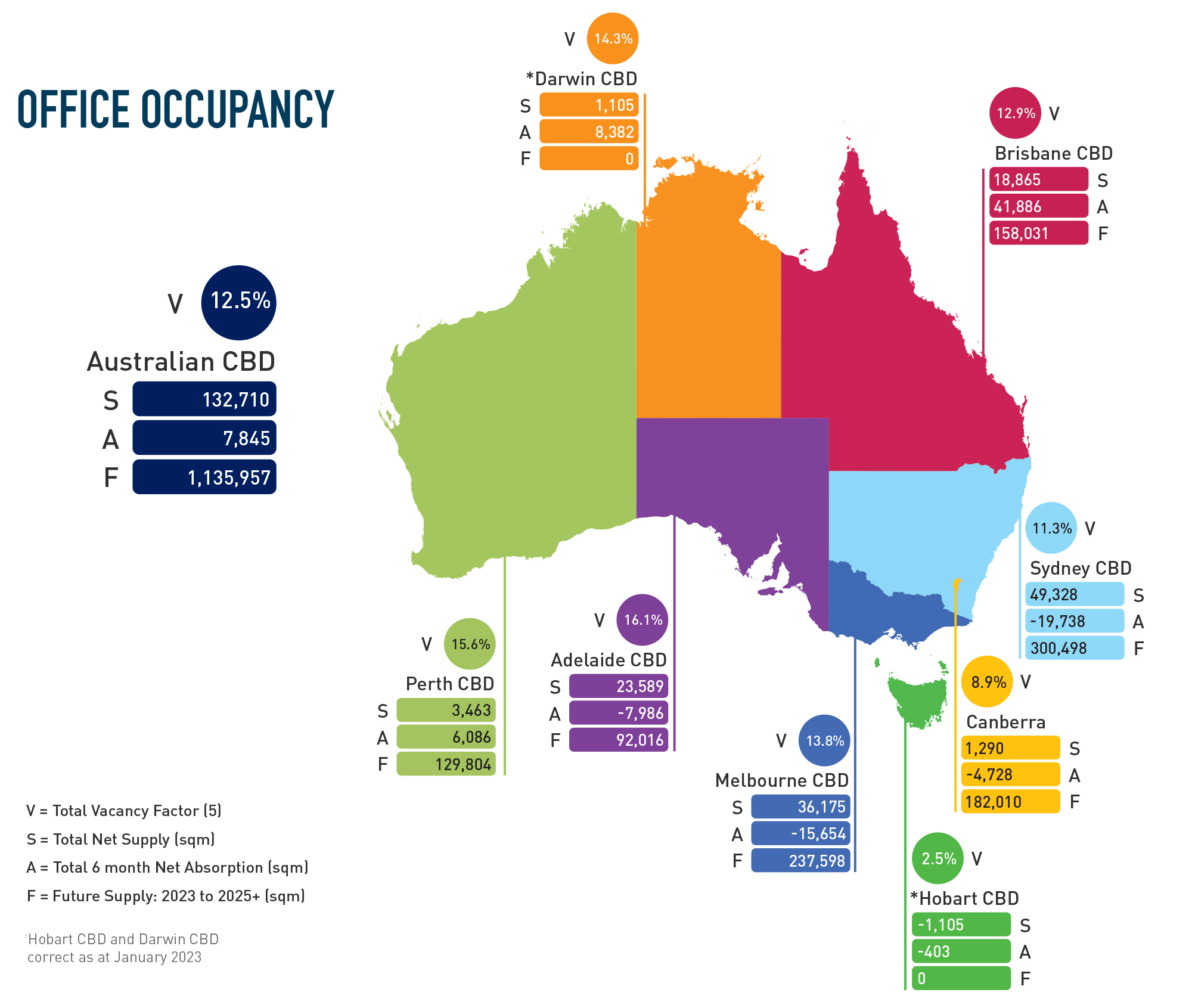

In the six months to January 2023, tenant demand outstripped supply in Brisbane, pushing the vacancy rate down from 13.9% to 12.9%. The PCA found that there is less than 100,000sqm of office space coming online in Brisbane over the next three years, 72% of which has already been pre-committed.

Similarly, vacancy declined marginally in Perth from 15.8% to 15.6%; and Hobart recorded a drop from 2.7% to 2.5% – now its lowest rate since 2008.

In other capitals, vacancy rates rose slightly – from 8.6% to 8.9% in Canberra; 10.1% to 11.3% in Sydney; and 12.9% to 13.8% Melbourne. Adelaide’s vacancy increased from 14.2% to 16.1%, driven by above average supply additions – as a result, the South Australian capital now has the highest vacancy rate in the country. In those markets where vacancy increased, there were moves toward prime stock over secondary stock. Non-CBD areas saw a decline from 15.2 to 15.1 per cent, with tenant demand lifting 0.3%.

Australian office space trends

There is a consensus among Australian property experts that the following represent the most prevalent emerging trends in the local market. These include:

- Workplace change is set to continue – hybrid working environments are now the overwhelming majority in most of Australia’s capital cities. As such, businesses are set to continue to evaluate, and adapt to, employees’ changing working preferences. Workspaces will continue to be reworked and refined over the foreseeable future to accommodate occupiers changing needs.

- The need to create a workplace experience – Knight Frank has found that there is an increasing expectation by building occupants that owners provide experiences and opportunities, including upgraded end-of-trip facilities, wellness centres, food and beverage options and more.

- Tenants’ ESG interest – ESG concerns are increasingly becoming front-of-mind for building occupiers and tenants, as well as the general population. As such, building owners will need to invest in environment and sustainability in their key decision-making processes going forward.

Examining office rents

According to the latest Cushman & Wakefield Marketbeat report, premium grade gross face rents rose 6.0% in Brisbane over the final 2022 quarter – to average $965 per square metre – one of the largest rises in recent years. A-grade also recorded an increase in gross face rents, though slightly more modest – at 1% QoQ (6% YoY) – and B-grade rents remained stable over the final quarter of 2023.

In the Sydney CBD, prime face rents held at an average of $1,410 sqm per year, increasing 4.2% over the course of 2022. Premium, A-grade and B-grade gross face rents averaged $1,525, $1,335 and $1,045 per square metre, respectively.