European property market update

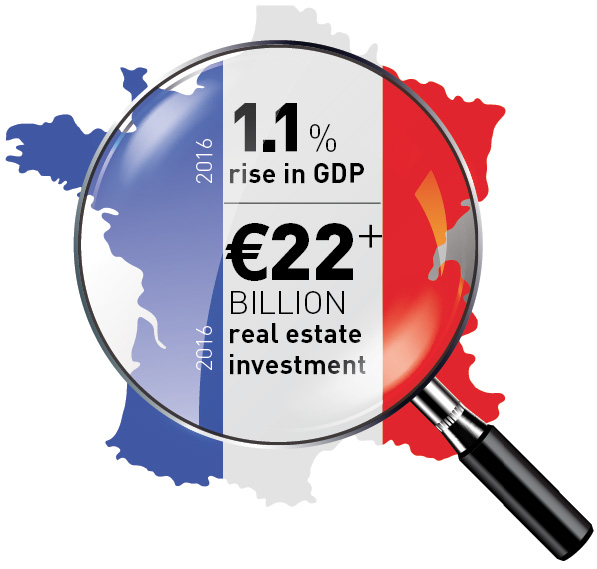

Europe’s political environment has filled a lot of newspaper columns over the past 12 months. Elections and, in the case of Brexit, a referendum, have all generated volatility in financial markets. Of course while some investors see this volatility as a risk, others see it as an opportunity. It is the depth and diversity of Europe’s real estate market across a variety of countries, cities, regions and sectors which makes it possible for investors to pursue a broad range of investment strategies, whatever their attitude to risk.

Focus on European cities

Following the UK’s decision to leave the EU last year, investment in German real estate overtook the UK for the first time, a trend which has continued into the first quarter of 2017. Despite this, London has seen increased levels of activity from Chinese investors, who continue to invest in the city, attracted by a combination of factors including the post-Brexit devaluation of the sterling and confidence that London will ultimately retain its position in the world order.

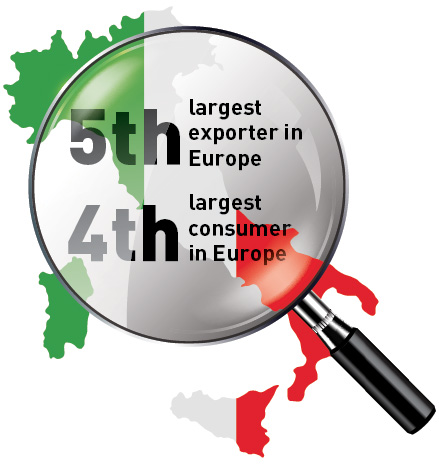

It is the strength of GDP growth in Europe’s major cities that is attractive to property investors. The dominant feature of the last 20 years has been the capacity of city economies to grow faster than the national average. Over the past decade, the three largest German cities have seen GDP growth 15% higher than the national average. London’s economy has expanded at an annual average rate of 2.9% compared to 1.2% for the UK and in Milan, growth is nearly double that of Italy.