Why Brisbane?

International destination

Brisbane is one of Australia’s primary tourist destinations, with its array of restaurants, galleries and shopping, but it also acts as a gateway to everything else Queensland has to offer. The Great Barrier Reef, Whitsunday Islands and rainforests of Far North Queensland are a short flight away, while the Gold Coast and its famous beaches are within driving distance.

In 2018, Queensland’s international visitor count for the year grew 2.3% to 2.8 million. The weak Australian dollar is helping drive an increase in tourism, with international tourists flocking down under, as well as nationals forgoing an international holiday to travel domestically.

It’s not just tourism drawing international visitors to Brisbane. With seven world-class universities and a number of private schools accommodating international students, it is no coincidence international enrolments in Queensland educational facilities rose 9.1% in 2018.

Liveability

When measured against cities across the world, Brisbane is attractive for its liveability.

In 2019, The Economist ranked Brisbane 18th out of 150 cities worldwide, based on the criteria of stability, infrastructure, education, healthcare and environment. Mercer, which uses similar yet more extensive criteria, placed Brisbane at number 35 out of 231 cities evaluated in their 2018 Quality of Life index.

Relative value

Along the east coast of Australia, Brisbane’s residential market is comparatively well placed. As at March 2019, the median apartment value in Brisbane was $372,900, whilst Melbourne was $466,900 and Sydney a whopping $696,900. Similarly, for houses, Brisbane holds an average price of $563,700, while Melbourne’s $809,500 and Sydney’s $1.03 million sit far higher.

Those priced out of the residential market in the southern cities can find value in Brisbane.

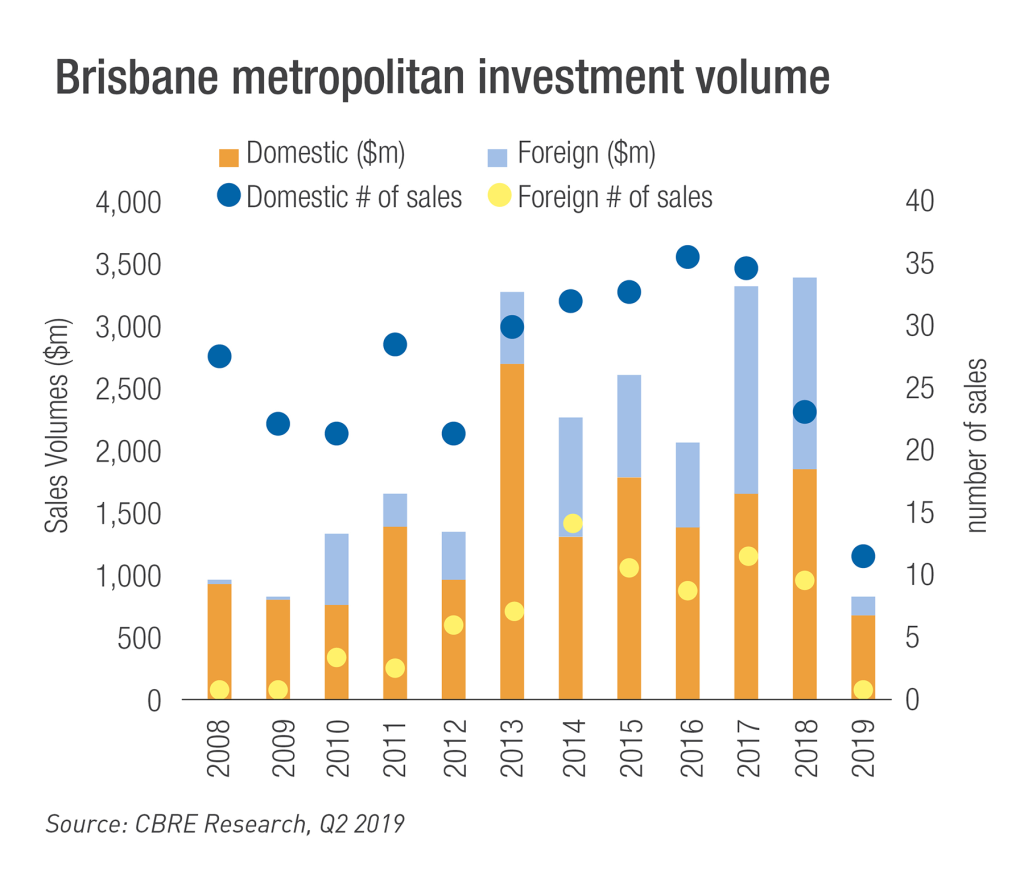

Brisbane is well placed within the wider Australian commercial market, and has an abundance of infrastructure projects in the works. It is little wonder the ‘River City’ is becoming an increasingly popular destination for international real estate investors.

| Project |

Cost |

Estimated Completion |

Description |

| Cross River Rail |

$5.4 billion |

2024 |

Set to be utilised by more than 160,000 commuters daily, the 10.2-kilometre rail line between Dutton Park and Bowen Hills will consist of almost six kilometres of tunnel beneath the Brisbane River and CBD. |

| Northshore |

$5 billion |

2035 |

With construction beginning in 2020, and spanning an area of 302 hectares, Northshore will be Queensland’s largest urban renewal project, consisting of high-end apartments, commercial space, retail, restaurants and bars. |

| Queen’s Wharf |

$3.6 billion |

2024 |

The 26-hectare integrated resort development will consist of five new hotels, as well as 50 bars, restaurants and cafes, a pedestrian bridge to Southbank, and is expected to draw an additional 1.39 million visitors to Brisbane each year. |

| Brisbane Live Precinct |

$2 billion |

2022 |

The Brisbane Live Precinct, located in Roma Street, will centre around a new 17,000-seat arena. |

| Millennium Square |

$2 billion |

2021 |

Millennium Square, located in Bowen Hills, is touted as the ‘city within a city’. It will consist of a state-of-the-art multimedia hub, residential towers, entertainment facilities and one-hectare garden. |

| Brisbane’s New Runway |

$1.3 billion |

2020 |

Brisbane’s New Runway is currently the largest aviation construction project in Australia. Once complete, Brisbane will have the best runway system in Australia, and current aircraft capacity will effectively be doubled. |

| Herston Quarter |

$1.1 billion |

2028 |

Linking old with new, Herston Quarter is set to become one of the nation’s largest and most complex biomedical precincts. The redevelopment is set to showcase the area’s local heritage, as well as provide aged care and retirement living, and residential accommodation. |

| Brisbane Metro |

$944 million |

2023 |

Construction has begun on Brisbane Metro, which will be a key part of Brisbane’s greater transport network, connecting the city to the suburbs. |

| West Village |

$800 million |

2023 |

Located on the fringe of Brisbane’s CBD, West Village will include seven residential buildings and about 13,000 sqm of retail and commercial space, alongside one hectare of open space linked by pedestrian and cycle laneways. |

| Brisbane International Cruise Ship Terminal |

$158 million |

2020 |

South-east Queensland currently does not have a dedicated facility able to accommodate mega cruise ships. However, once complete, the Brisbane International Cruise Ship Terminal will be able to cater to the largest vessels in the world. |

| Queensland Cultural Centre |

$150 million |

2022 |

The new development at Southbank will serve as the Queensland Performing Arts Centre’s fifth theatre, and will in turn make QPAC the largest performing arts centre in Australia. |

Brisbane CBD comprises over 2.2 million sqm of office stock, making it just under half the size of the Melbourne CBD and slightly smaller again when compared to Sydney. Its vacancy, however, is a lot higher, albeit on a downward trajectory having dropped to 11.9%, from 12.9% just six months previously. Brisbane fringe vacancy contracted from 15.7% to 13.8% over the same period.

Brisbane CBD comprises over 2.2 million sqm of office stock, making it just under half the size of the Melbourne CBD and slightly smaller again when compared to Sydney. Its vacancy, however, is a lot higher, albeit on a downward trajectory having dropped to 11.9%, from 12.9% just six months previously. Brisbane fringe vacancy contracted from 15.7% to 13.8% over the same period.