Research and Insights

Global economic outlook

World gross domestic product (GDP) growth slowed over the last year, but there are some signs that momentum is turning. Central banks have relaxed monetary policy since the start of 2019, Chinese authorities have intervened to support domestic growth momentum, the tariff wars may prove less destabilising than originally thought, and expansionary fiscal policy has been implemented across many key Asian markets.

Global growth is projected to be around 2.9% p.a. on average over the next five years, although Australia’s trading partners’ economies are forecast to grow at 3.8% over the same period. Long-term GDP growth, however, will be structurally weaker than in the past due to slower population growth and more limited improvements in productivity.

Australia’s economic outlook

GDP growth remains weak, at 1.4% for the 12 months to 30 June 2019. The key factor remains subdued household consumption. Although lower interest rates and income tax cuts are generally supportive, the Australian consumer seems to have their hands firmly in their pockets.

GDP growth remains weak, at 1.4% for the 12 months to 30 June 2019. The key factor remains subdued household consumption. Although lower interest rates and income tax cuts are generally supportive, the Australian consumer seems to have their hands firmly in their pockets.

Residential building has turned down sharply and is likely to be a large drag on growth until late- 2020. Conditions remain conducive to a pick-up in business investment, as monetary conditions are accommodative and utilisation rates are high, but deteriorating confidence and some remaining uncertainty around the global outlook is causing firms to take pause.

Mining investment will trough soon, however, and the absence of any drag will support growth. Underlying export demand continues to be strong and will contribute around 2.1% of GDP growth for FY19 and FY20 before stronger growth of around 3% thereafter.

Employment growth also remains healthy, but price pressures are weak and wage growth is only slowly trending higher. The RBA lowered the cash rate by 25 basis points in June, July and October and is likely to pause now with the cash rate at a record-low 0.75%.

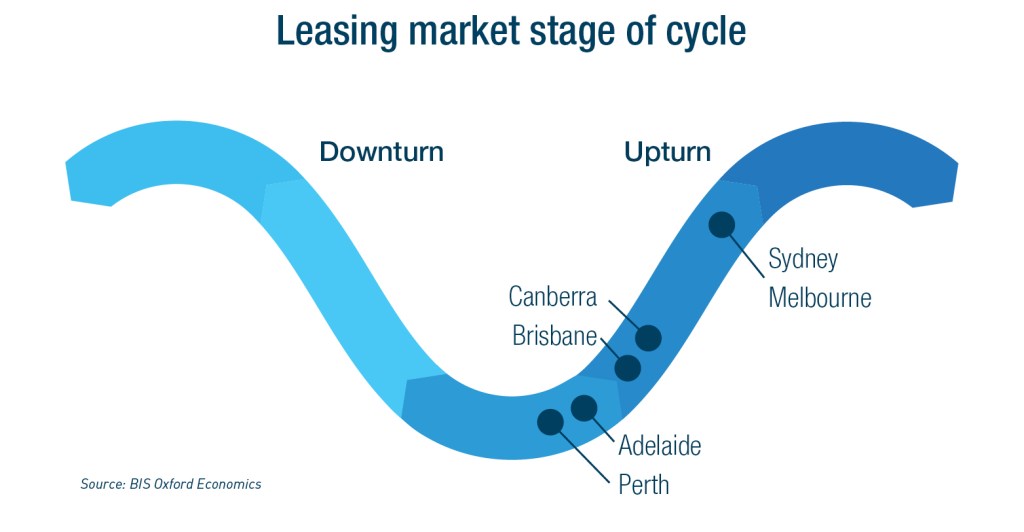

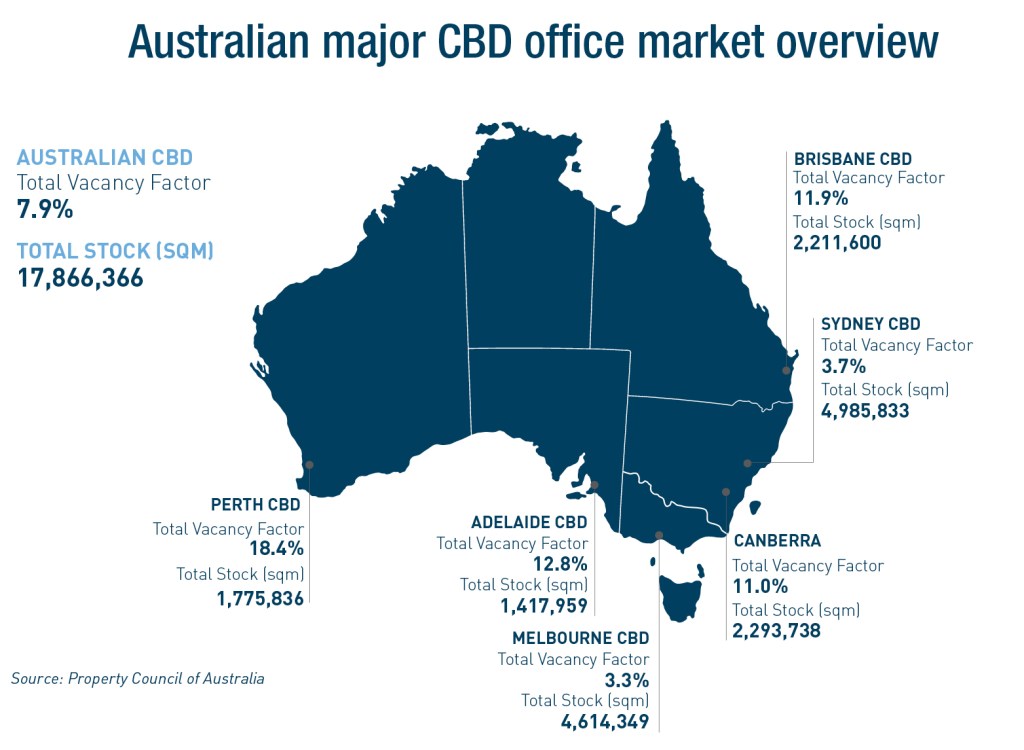

Office markets

Australia’s major office markets are at different stages of the office cycle. CBD vacancy rates range from 3.3% in Melbourne to 18.4% in Perth. Sydney and Melbourne have the tightest leasing markets and offer strong rental growth prospects over the next five years. They also offer the best five-year investment returns, albeit the ten-year returns are much lower.

For the other major capital city markets, the converse is true. Ten-year returns eclipse five-year returns, reflecting stronger leasing conditions further out in the cycle. In Brisbane, Perth and Adelaide, we are past the trough in the cycle, but recovery in demand will be slow and it will take time for vacancies to fall.

In Brisbane, new supply could delay the recovery. In Canberra, the A-grade market is tight and returns will be solid over the medium to longer-term, but the market remains strongly driven by the requirements of government.

Industrial market overview

Australia’s eastern seaboard industrial property markets continue to experience strong occupier and investor demand. Construction of new space is struggling to keep pace with demand, leading to declining vacancy rates and, particularly in already built-up areas, putting upwards pressure on rents.

Meanwhile, the sector has delivered strong capital gains over the past five years. Most of that has been the result of firming yields, with rental growth only recently joining the equation. The resulting investment returns were amongst the strongest of all property investment classes in Australia over the past 12 to 18 months.

Retail sector outlook

The retail property market in Australia continues to face difficult conditions. The pace of retail turnover growth is weak from a long-term historic perspective. Data indicates 2.4% year-on-year growth, reflecting the volatility of the sector. The pattern of soft turnover growth is consistent with soft wages growth and weak consumer sentiment.

In the investment market, activity has slowed and, with more sellers than buyers, yields have started to soften for all centre types bar regional centres.

There are numerous examples of properties being sold for below book value or last valuation. We are likely to see further softening of non-core centre yields as investors increasingly question an asset’s income growth prospects.

The outlook for property returns

Investment returns from commercial property across Australia over the next five years will be well below those achieved over the past five years. The strength of recent returns was, for the most part, the result of falling bond rates driving firming yields, often completely out of lock-step with leasing fundamentals. The weight of money chasing investment property fuelled the fall.

Across most capital cities and sectors, yields have continued to firm over the year. Indeed, with bond rates reaching new lows, we have pushed back the expected timing of a turnaround (rise) in bond rates and associated yield softening, although the medium-term direction is unlikely to change.

Near term, yields could continue to firm modestly. There is still a significant differential between yields on offer for Australian property and those in Asian city markets, and both local and international investor demand for Australian property remains strong.

Moreover, most property markets that experienced oversupply following the end of the mining investment boom are now in a recovery stage of the cycle.

Industrial yields appear to offer the greatest scope for near-term firming. By contrast, retail yields (other than for regional centres) are showing signs of softening in response to risks around centre income returns.

As such, we expect office yields in Sydney and Melbourne to soften only once rentals start to decline in about five years. In the smaller city markets, where yields have firmed despite weak leasing conditions, there is a greater risk of yields softening in line with bond rate movements.

Many investors, institutional and private, will struggle to meet current hurdle rates of return on a five-year investment horizon. Lease expiry profile and vacancy risk will be critical, as will be value-add development opportunities. Investors may need to consider either a shorter, or alternatively a longer-term, time horizon for investments to stack up.